Understanding Fractional CFO Services

In today’s competitive landscape, effective financial leadership is essential for businesses of all sizes. However, the significant cost of hiring a full-time Chief Financial Officer

If you don’t want to run into cash flow problems in your business then it’s important to implement industry best practices. One of those is a 13 week cash flow model.

The 13 week cash flow model is a method where companies forecast their financial liquidity over a quarter. But why make it 13 weeks?

The choice of 13 weeks is strategic it is a short enough period for businesses to make real-time adjustments and long enough to identify trends. This span offers a realistic window into a company’s immediate financial health.

There are undeniable advantages of a 13 week cash flow. Take a look at some of them:

A cash flow forecast is obviously useful at any stage of a business’ life. It’s especially valuable though when you are expanding or planning growth. Good cash flow management is essential during these times. When your business is facing financial uncertainties, a 13 week perspective can be what saves you from making a small error that leads into a huge problem. By strategically planning for the upcoming months, you can identify potential issues, plan appropriately and set short-term goals that won’t lead to cash issues.

The 13 week cash flow model is a great tool for businesses, especially small to medium sized businesses. It helps you with:

1. Short-term clarity

While longer forecasts create a broad picture, the 13 week cash flow offers an immediate look, help your business cover essential outlays such as payroll and rent.

2. Financial management

A regularly updated 13 week cash flow forecast helps managers swiftly adjust to unforeseen changes.

3. Informed decisions

With a clear view of your finances you’re empowered to make sound decisions, from investments to potential delays in plans.

4. Spotting trends

Regular cash flow tracking reveals patterns, allowing you to strategize better and address consistent challenges.

5. Boosting stakeholder trust

When investors, lenders, and stakeholders can see that you’re proactively in control of your cash flow management, they’re more likely to have confidence in your decision making and business success.

6. Bracing for the unexpected

From global crises to client losses, a 13-week forecast helps businesses prepare and adapt to unpredictable hurdles.

It is easy enough to build. Here are 5 steps to getting your 13 week cash flow model set up:

1. Document existing cash: Start with your current cash position.

2. Forecast collections: Estimate incoming cash based on invoices and other receivables.

3. List outlays: Factor in wages, rent, suppliers, and other costs.

4. Calculate net flow: Subtract outlays from collections.

5. Estimate ending cash: Add net flow to the initial cash.

Remember, this model is the most beneficial if you update your information regularly. This can become complex and time consuming very quickly if you’re not experienced at forecasting cash flow or have a high volume of cash movements. It’s best to speak to an expert who can help you with cash flow management services.

There are lots of forecasting methods in the financial world, the 13-week cash flow holds a distinctive position among them. Here are some points that we believe sets the 13 week cash flow apart from the rest:

Duration & Detail: The 13-week cash flow model provides a quarterly perspective, while other forecasting methods might offer half-yearly or yearly insights.

BENEFITS: The shorter duration means the 13-week model provides more detail, this will enable your business to closely monitor and react to changes.

Real-time Adjustments:Unlike a 6-month or yearly forecast, which might provide broader insights of financial health.

BENEFITS: the 13-week model allows businesses to make real-time adjustments, making it easier to counteract any unforeseen cash flow issues.

Accuracy: With the 13 week cash flow, their is less room for external factors to disrupt forecasts.

BENEFITS: The 13-week cash flow model is therefore more accurate for short-term planning than longer-term forecasts.

Trend Identification: By focusing on a quarter, businesses can better pinpoint recurring financial trends or anomalies.

BENEFITS: This is useful for seasonal businesses, where cash flow can greatly vary depending on the time of year.

Flexibility: The dynamic nature of the 13-week cash flow model means it’s easily updated. In contrast, longer-term forecasts might become quickly outdated if not regularly revised.

BENEFITS: this will allow your business to be more flexible in its decision making, allowing you to make changes when needed.

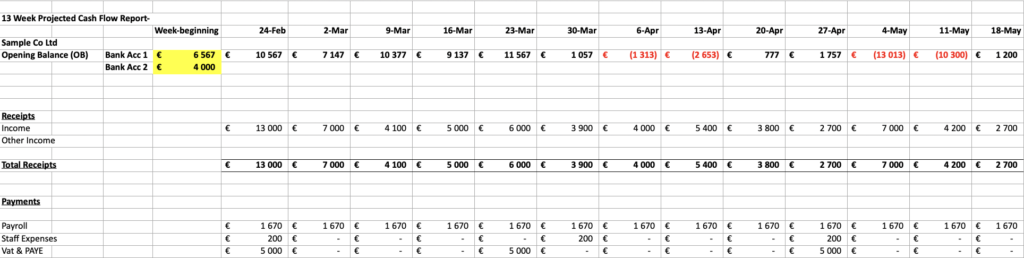

Templates can simplify the process. They standardize input areas, ensuring that no detail is overlooked. The right template is both comprehensive and intuitive. Depending on how your business processes cash flow, a simple 13 week rolling cash flow forecasting template could be ideal to help you get started. Below is a quick example we have drawn up to help you have an idea of what kind of 13 week cash flow model can look like.

As with anything there is room for error. If you don’t commit to regular updating your cash flow model then the information shown in the forecast becomes irrelevant. Some of the pitfalls to avoid include:

Perfecting your 13 week cash flow forecast is an ongoing task. As you become more familiar with the process, there are additional financial strategies that you can use to improve cash flow, such as:

Remember that the value of the 13 week cash flow model is maximized when it’s viewed as a living document. You need a forecast that’s easy to maintain but also gives you real-time, accurate and reliable information.

At Ease Support we can provide you with a custom, 13 week rolling cash flow model that’s built for your business and connected to your accounting software. You’ll have a forecast that auto-updates on a weekly basis and enables you to manage your cash flow effectively. Click to view our cash flow management services below.

In today’s competitive landscape, effective financial leadership is essential for businesses of all sizes. However, the significant cost of hiring a full-time Chief Financial Officer

In today’s fast-paced business world, getting your finances in order is key. From small startups to established businesses, everyone’s looking for ways to make their

Businesses frequently use outsourcing as a way to increase efficiency, save costs, and simplify operations in today’s international market. Offshore and back-office outsourcing are two

1048 Irvine Ave #728

Newport Beach