5 Ways AI Bookkeeping Can Save You Time

We all know that time management is essential for small and medium sized businesses to succeed, which is why AI Bookkeeping is such a popular topic at the moment.

Bookkeeping can be time consuming and tedious, which can take away from more important work. We know that for small to medium-sized businesses efficient time management can be the difference between growth and stagnation. Fortunately, with the rise of AI bookkeeping services in California and beyond, it has allowed many bookkeeping tasks to become quick and easy.

We are going to look into 5 ways that bookkeeping and AI can save you time and help you manage your finances more effectively.

Way 2: Real-time Financial Analysis

Way 3: Intelligent Expense Categorization

Way 4: Enhanced Fraud Detection

The time-consuming challenges of traditional bookkeeping

Traditional bookkeeping involves a lot of manual processes that are prone to human errors. It’s also very time consuming. From data entry into spreadsheets or accounting software, to transaction reconciliation, this can take hours and is often really tedious. Correcting mistakes not only costs money but also wastes precious time.

When you have data entry errors your reports won’t be accurate or reliable and could lead to tax compliance issues. Below, we’ve outlined 5 key ways that using AI bookkeeping can save you time and minimize these errors.

1. Automated data entry

One of the standout features of AI bookkeeping software is its ability to automate data entry. This saves time and reduces the risks of errors. Instead of manually inputting each transaction, AI algorithms can scan, interpret, and record data in real-time. AI-powered bookkeeping software can automatically extract data from receipts and invoices, eliminating the need for manual data entry. This not only reduces the margin for error but also saves countless hours that can be better spent on strategic planning or customer engagement.

A few AI accounting platforms that automate data entry are:

- QuickBooks Online

- Xero

- Sage Intact

- Receipt Bot

- Nanonets AI

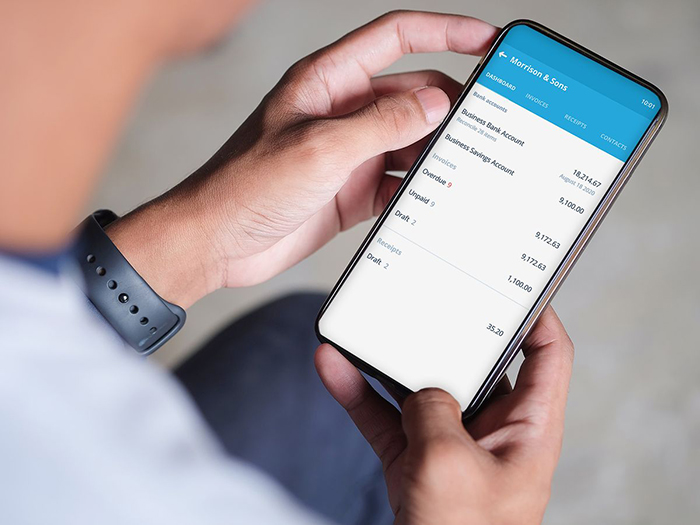

2. Real-time financial analysis

AI is incredibly fast at processing and analyzing financial data. With bookkeeping AI, you can get instant insights into your business’ financial health. This helps with better and quicker decision-making.

Tired of waiting for end-of-month reports, an AI bookkeeper provides real-time financial snapshots and reliable data.

A few AI bookkeeping programs that offer real-time financial analysis include:

- Zeni

- Booke AI

- Docyt

- Datarails

- Truewind.ai

3. Intelligent expense categorization

AI bookkeeping tools can automatically categorize your expenses. Expense categorization can be a tedious task so this eliminates the need for manual entries, saving time and reducing the risk of errors.

An AI bookkeeper can perform tasks like automatically categorize expenses based on past transactions. This can save you hours of work each week and can ensure that expenses are accurately categorized.

A few AI bookkeeping programs that offer intelligent expense categorizations are:

- Receipt Stash

- LedgerDocs

- Docyt

- Quickbooks Online

- Xero

4. Enhanced fraud detection

Financial anomalies can be hard to spot. AI bookkeeping can quickly identify them and potential fraud, saving time in manually sifting through transactions for any discrepancies. AI for bookkeeping has made fraud detection more efficient as the AI-powered bookkeeping software can perform functions like detect duplicate transactions and flag them for review. By analyzing transaction patterns, AI can quickly identify irregularities. This obviously can save your business hours of work each week and reduce the risk of fraud.

Some tools that offer enhanced fraud detection are:

- Data Robot

- Fraud.net

- EY

- SEON

- Comply Advantage

5. Streamlined E-commerce bookkeeping

E-commerce bookkeeping can be challenging due to the large volume of transactions and the need to track inventory instantly. From tracking online sales to managing digital receipts, and inventory levels it can be overwhelming. AI can address these challenges efficiently, especially for small online businesses.

AI bookkeeping can perform functions like automatically tracking inventory levels, updating them in real-time and alerting you when they drop below a certain level. This can save businesses hours of work each week and ensure that inventory levels are accurate. For any E-commerce business, live inventory is essential. It allows the business to make ordering products, marketing and advertising easy. It also avoids wasting money and time making decisions based on old data.

A few AI bookkeeping programs that offer streamlined E-commerce bookkeeping are:

- LedgerDocs

- Booke AI

- QuickBooks Online

- Xero

- Wave

The broader impacts of time saved

The time saved through AI bookkeeping can have ripple effects throughout a business. With time in hand, you as a business owner can focus on growth strategies, improve work-life balance, and even explore new market opportunities.

Real-world testimonials and case studies show that businesses have benefited from the time saved by using AI bBookkeeping platforms.

Choosing the right AI bookkeeping solution

While the benefits of an AI bookkeeper are clear, it is crucial to choose the right solution. Look for AI bookkeeping software that has automated data entry, real-time financial analysis, intelligent expense categorisation and enhanced fraud detection.

By automating manual tasks and increasing efficiency, your business can cut costs and allocate resources more effectively to support business growth.

Make sure you don’t forget to factor in the software’s scalability, its integration capabilities, and, of course, its cost. Some of the more popular bookkeeping software options on the market are QuickBooks, Xero, Zeni, Envoice and Finaloop.

Conclusion

While the question has been asked, “will AI replace bookkeepers?”, the reality is that AI is here to enhance, not replace.

Human oversight, combined with AI’s efficiency creates a powerful duo in the financial world. Modern bookkeepers can use platforms that incorporate AI to enhance the bookkeeping services they offer you. They can oversee the functions that AI performs and use AI bookkeeping to provide forecasts, trends, data analysis and advice.

While the advantages of AI in bookkeeping are numerous, it’s also important that you consider how an over-reliance on AI can be bad for your business. AI is still a cold, data tool and may not accurately be able to input and interpret more complex, or localized scenarios.

For businesses in California and beyond, embracing AI bookkeeping is a smart choice. At Ease Support we are forward thinking bookkeeping solutions that embrace technology that benefits our clients. Click below to view our range of services.