Understanding Fractional CFO Services

In today’s competitive landscape, effective financial leadership is essential for businesses of all sizes. However, the significant cost of hiring a full-time Chief Financial Officer

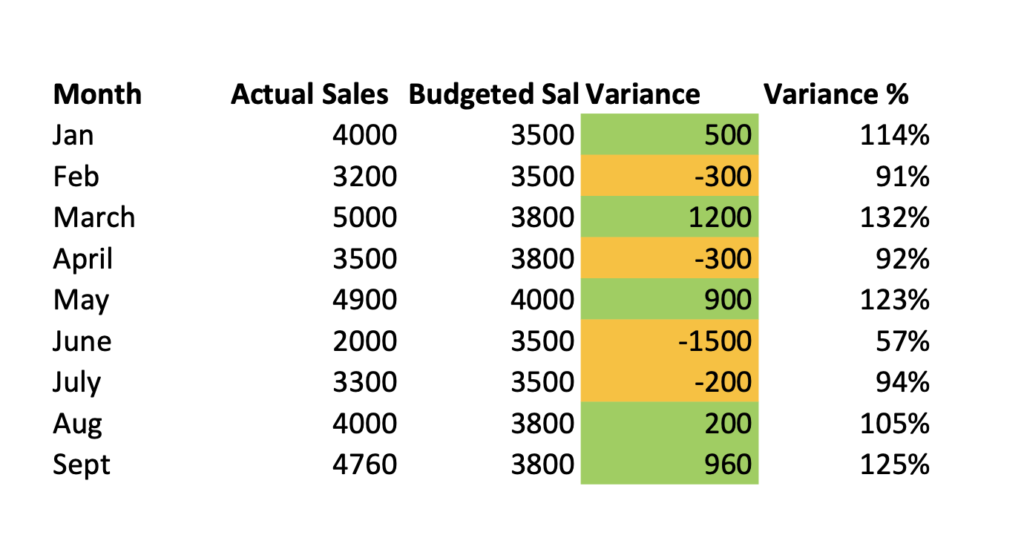

A variance report is a financial document that compares actual performance against budgeted or planned performance in specific categories such as revenues, expenses, and overall profit. For a small business owner, it serves as a diagnostic tool to identify operational inefficiencies, assess financial health, and make informed decisions. By analyzing the variances between actual and projected figures, you as the business owner can pinpoint areas that require your attention, allocate resources more effectively, and adapt your strategies for better financial performance.

In this guide to understanding financial reports:

Put simply a variance report is an essential financial document that shows the differences between expected financial outcomes and actual results. It will highlight areas of strength and should expose unexpected pitfalls.

Every business sets financial targets or at least should. A variance report discloses how close or far a business is from hitting those targets. This is crucial for businesses, as it highlights what areas need attention and where the business is excelling. When businesses are aware of this they are able to act with confidence and respond to the trends that are shown.

Here’s a simple breakdown of how variance reporting works:

If a business outperforms its forecasts, it is called a favorable variance. Alternatively, if it falls short, it has an unfavorable variance. Understanding these variances can help you adjust your business strategies.

Here is a budget variance report example:

Creating a variance report can be a straightforward process and the results can be incredibly insightful. To help you create one for your business you will need to:

A key thing to remember is that a variance report isn’t just about presenting data. A key element is understanding and interpreting that data to guide your business decisions. As you become more accustomed to variance reporting, you’ll find it becomes a useful report that you refer to whenever making a decision in your business.

Often larger enterprises have entire departments who are dedicated to analyzing the finances. Small to medium-sized businesses however, lack the back office accounting support to do this on a regular basis for them. You’ll need to create your own reports or outsource this service to a specialist in variance reporting, usually an accounting firm that provides CFO services.

As your business grows, it is important to understand your finances and whether or not you’re on track. With the right information you’ll be empowered to take proactive steps, based on real data, to direct your business in the right directions towards growth.

There are 3 main reasons as to why you need one:

A well-structured variance report ensures these 3 things – clarity, comprehensibility, and actionable insights.

Here’s a breakdown of what a comprehensive variance report – whether it’s a standard report or a specialized budget variance report – should include:

As you can see your variance report must be up to date and based on real numbers, otherwise it will not be useful.

Variance reporting is an extremely useful financial tool in any business. At Ease Support, we can provide you with monthly variance reports as part of our advisory and CFO services. Contact us for more information.

In today’s competitive landscape, effective financial leadership is essential for businesses of all sizes. However, the significant cost of hiring a full-time Chief Financial Officer

In today’s fast-paced business world, getting your finances in order is key. From small startups to established businesses, everyone’s looking for ways to make their

Businesses frequently use outsourcing as a way to increase efficiency, save costs, and simplify operations in today’s international market. Offshore and back-office outsourcing are two

1048 Irvine Ave #728

Newport Beach